401k disbursement calculator

You think youll live to 100 years old 2Interest Rate. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and.

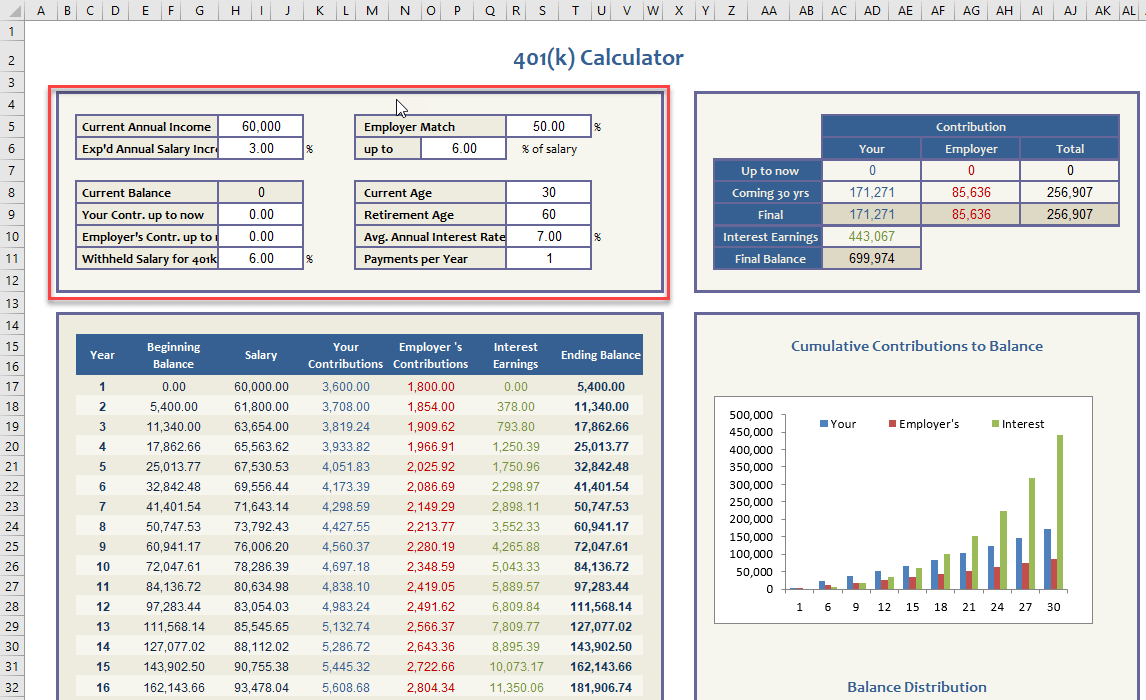

Customizable 401k Calculator And Retirement Analysis Template

Contributing to a 401 k is one of the best ways to prepare for retirement.

. This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years. This helps illustrate the cost of providing a. Ad Open a Roth or Traditional IRA CD Today.

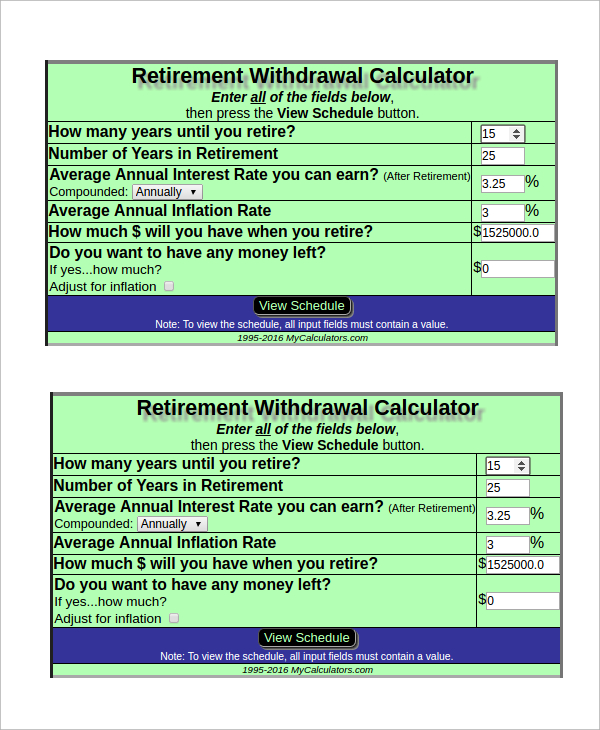

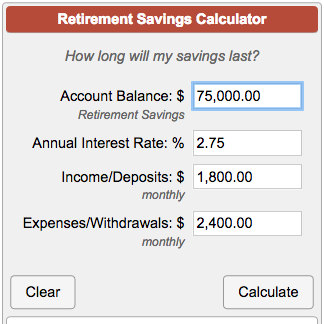

Now you want to know how much you can spend each year. As an example we will enter 100000 as the account. Discover Bank Member FDIC.

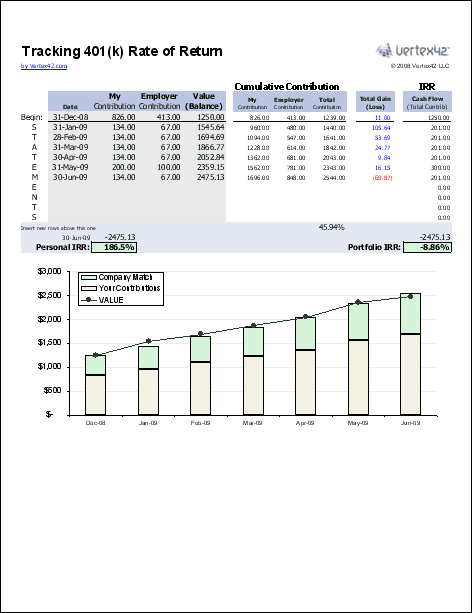

The Bipartisan Budget Act of 2018 mandated changes to the 401 k. Using this 401k early withdrawal calculator is easy. Do Your Investments Align with Your Goals.

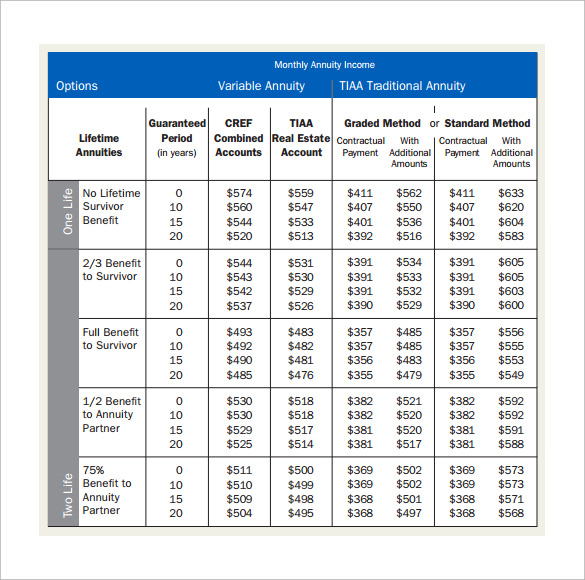

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad TIAA Can Help You Create A Retirement Plan For Your Future.

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security. Dont Wait To Get Started. Forbes Advisors 401 k calculator can help you understand how much you can save factoring in your.

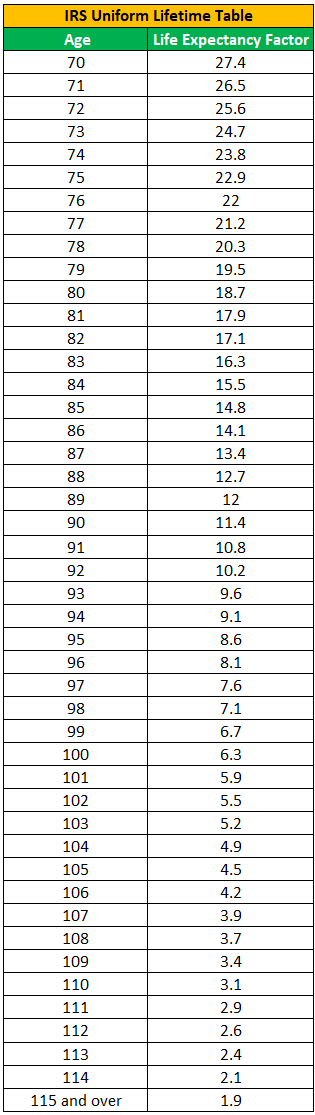

Rolling Over a Retirement Plan or Transferring an Existing IRA. Compare 2022s Best Gold IRAs from Top Providers. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Use this calculator to determine your Required Minimum Distribution RMD. If you need to tap into. Anything your company contributes is on top of that limit.

A 401 k plan may allow you to receive a hardship distribution because of an immediate and heavy financial need. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. Not an easy task.

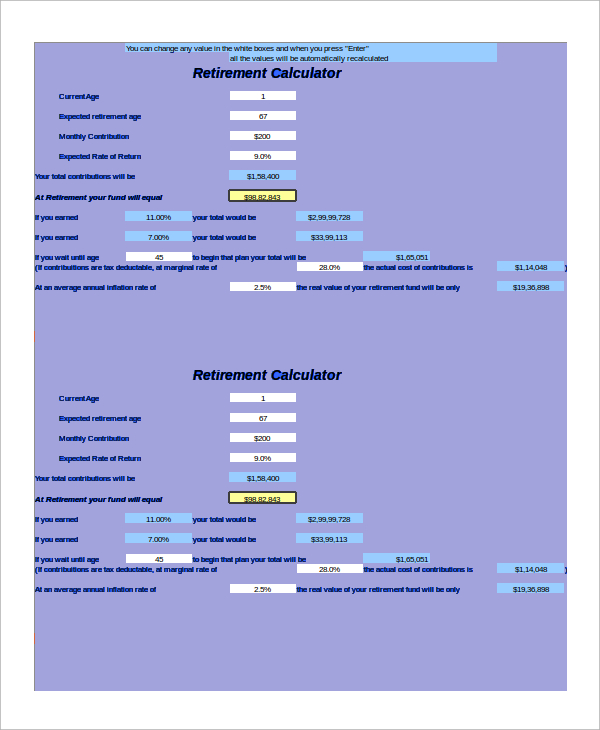

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return.

For instance a person who makes 50000 a year would put away anywhere. Find a Dedicated Financial Advisor Now. It is mainly intended for use by US.

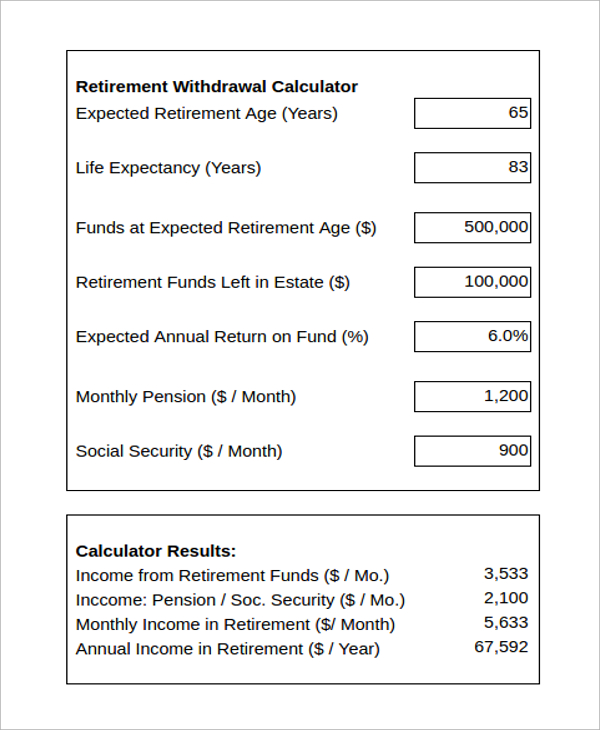

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. Understand What is RMD and Why You Should Care About It. Find a Dedicated Financial Advisor Now.

Retirement Distribution Calculator Retirement Distribution Calculator KeyBanks Retirement Distribution Calculator takes the guesswork out of planning for retirement and helps you see. This begins at end of the first year of distributions. This calculator increases your distribution amount at the end of each year by the rate of inflation.

This is a very. Your employer needs to offer a 401k plan. Whether you are looking for a retirement score or a retirement income calculator Fidelitys retirement tools calculators can help you plan for your retirement.

401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will resu See more. The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals.

Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from. Do Your Investments Align with Your Goals.

Choose the appropriate calculator below to compare saving in a 401 k account vs. It provides you with two important. Reviews Trusted by Over 45000000.

In 2022 you can contribute 20500 to a 401 k. 6Years until you retire age 65 35Years of retirement. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement.

Discover Makes it Simple. Those who are 50 years or older can invest 6500 more or 27000.

401k Calculator

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

/GettyImages-155379499-a7f64925872c4efcb1923a6e64249736.jpg)

Can Your 401 K Impact Your Social Security Benefits

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

401 K Retirement Calculator With Save Your Raise Feature

401k Retirement Withdrawal Calculator Factory Sale 54 Off Www Ingeniovirtual Com

Required Minimum Distribution Calculator Estimate The Minimum Amount

Traditional Vs Roth Ira Calculator

Retirement Calculator 401k Clearance 58 Off Www Ingeniovirtual Com

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Free 9 Sample Retirement Withdrawal Calculator Templates In Pdf

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

401k Retirement Withdrawal Calculator Outlet 60 Off Www Ingeniovirtual Com

401k Calculator Withdrawal On Sale 58 Off Www Ingeniovirtual Com

401k Retirement Withdrawal Calculator Best Sale 59 Off Www Barribarcelona Com

Retirement Savings Calculator

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com